Busy Contacts 1 2 11 – Fast Efficient Contact Managers

- Busy Contacts 1 2 11 – Fast Efficient Contact Managers Jobs

- Busy Contacts 1 2 11 – Fast Efficient Contact Managers Make

- Busy Contacts 1 2 11 – Fast Efficient Contact Managers Make

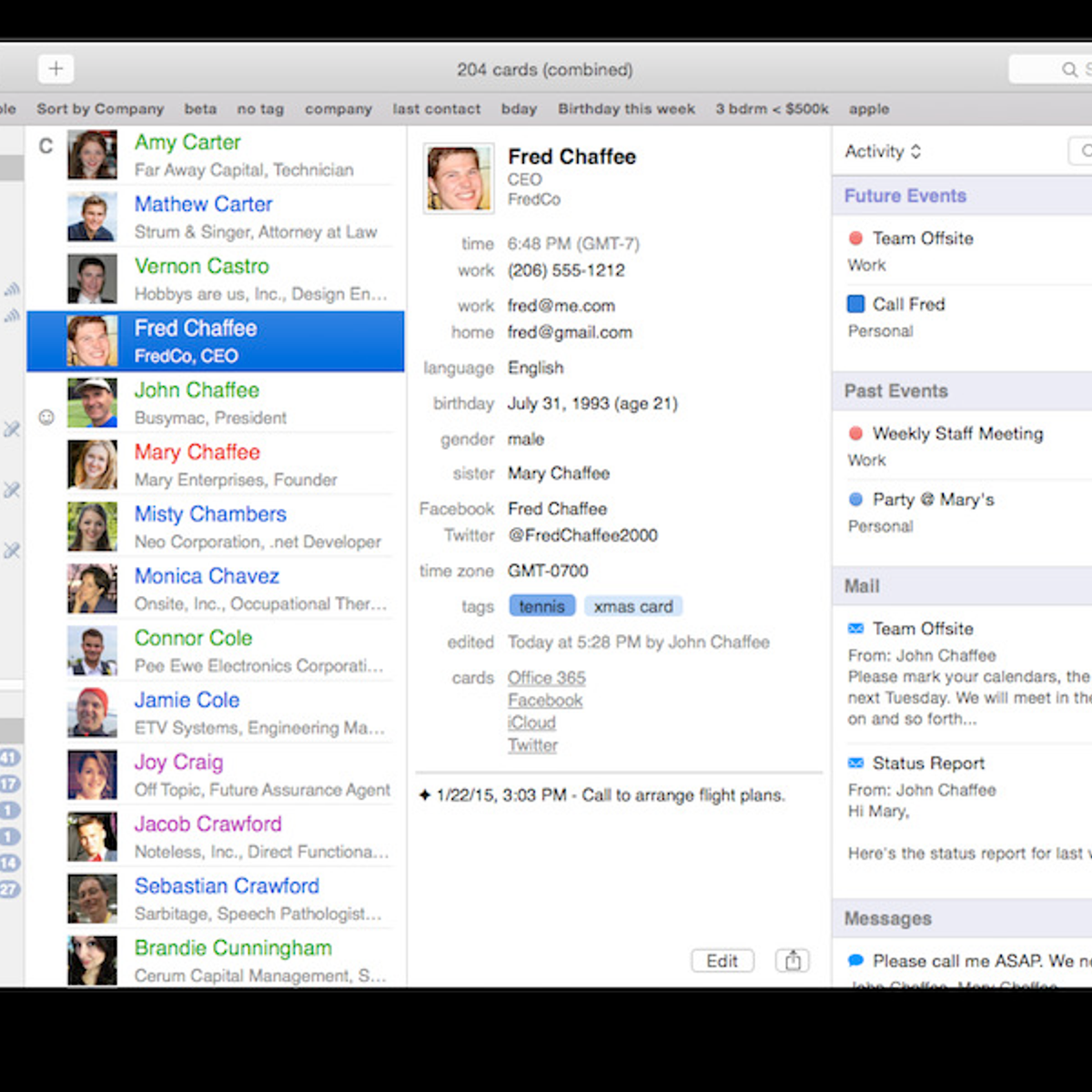

Start workflows from any app Pick a trigger that sets your Zap into motion. Finish routine tasks automatically Zaps complete actions, while you solve more important problems. Busey promises to give you the assistance and answers you need to keep your business successful and nimble. With solutions designed specifically for your business, our treasury management team will analyze your cash flow needs and recommend ways to make the most of your money through automated solutions. The crew came on time and cleaned the house from top to bottom. It sparkled by the time they left. They're efficient and fast. A crew of 4 cleaned the house in 2 1/2 hours. I can't recommend them highly enough. Give Geraldo a call. His crew will clean your house like it's theirs and they're expecting company. Oct 31, 2017 BusyContacts 1.2.4 – Fast, efficient contact manager. October 31, 2017 BusyContacts is a contact manager for OS X that makes creating, finding, and managing contacts faster and more efficient.

CHAMPAIGN, Ill., July 03, 2017 (GLOBE NEWSWIRE) -- First Busey Corporation (“Busey”) (NASDAQ:BUSE), the holding company for Busey Bank, today announced the completion of its previously announced merger with First Community Financial Partners, Inc. (“First Community”) (NASDAQ:FCFP), the holding company for First Community Financial Bank. The transaction was announced on February 6, 2017.

Macclean 3 6 0. Under the terms of the definitive agreement, at the effective time of the merger, each share of First Community common stock issued and outstanding as of the effective time was converted into and constituted the right to receive 0.396 shares of Busey common stock and $1.35 in cash. Based on Busey’s five-day volume weighted average closing price of $29.27 on June 30, 2017, the implied per share purchase price was $12.94 with an aggregate transaction value of approximately $235.5 million. Busey will operate First Community Financial Bank as a separate banking subsidiary of Busey until it is merged with Busey Bank, which is expected to occur in the fourth quarter of 2017.

First Busey President and Chief Executive Officer Van A. Dukeman said, “This business combination is consistent with our strategy of expanding into markets with both population and commercial density in the Midwest through disciplined partnerships with companies who have similar operating and cultural philosophies. Joining together with First Community offers significant growth possibilities for the combined associate, customer, community and shareholder base.” Violated hero gallery save.

First Community had total consolidated assets of $1.34 billion, total loans of $1.05 billion and total deposits of $1.11 billion as of March 31, 2017.

Roy C. Thygesen, Chief Executive Officer of First Community, said, “We are excited First Community customers will be able to take advantage of an expanded array of commercial, consumer and wealth management services and capabilities. As importantly, our combined size gives us the lending capacity to support growth in our clients’ credit needs for years to come, delivered in the community banking approach they have come to expect, by the same experienced professionals they know and trust.” Xilisoft iphone magic platinum 5 7 28.

Both companies value an engaged and empowered workforce and are committed to building a premier, service-oriented, community experience. Busey has been consistently recognized among the Best Places to Work in Illinois since 2016 by Best Companies Group and additional partners, as well as named one of the 2016 Best Banks to Work For by American Banker magazine. Further, both Busey and First Community were named among the top performing small-cap banks and thrifts—Sm-All Stars—by Sandler O’Neill + Partners, L.P. https://eayjzt.over-blog.com/2021/01/adobe-premiere-pro-cc-2018-mac.html. in 2016; they were two of only 26 selected in the nation, and the only two Illinois banks to be named.

Busy Contacts 1 2 11 – Fast Efficient Contact Managers Jobs

Barack Ferrazzano Kirschbaum & Nagelberg LLP served as legal counsel to First Busey Corporation and Stephens Inc. served as financial advisor and provided a fairness opinion to First Busey Corporation. Howard & Howard Attorneys PLLC served as legal counsel to First Community Financial Partners, Inc. and FIG Partners served as financial advisor and provided a fairness opinion to First Community Financial Partners, Inc.

Busey Corporate Profile

Following the merger, First Busey Corporation (NASDAQ:BUSE) is an approximately $7 billion financial holding company headquartered in Champaign, Illinois. Busey Bank, First Busey Corporation’s wholly-owned bank subsidiary, is also headquartered in Champaign, Illinois and has twenty-eight banking centers serving Illinois, thirteen banking centers in the St. Louis, Missouri metropolitan area, five banking centers serving southwest Florida and a banking center in Indianapolis, Indiana. Busey Bank also offers mortgage loan products through fifteen loan production offices in the St. Louis, Kansas City, Chicago, Omaha-Council Bluffs metropolitan areas and across the Midwest. Trevett Capital Partners, a wealth management division of Busey Bank, provides asset management, investment and fiduciary services to high net worth clients in southwest Florida. Busey Bank had total assets of $5.4 billion as of March 31, 2017.

First Community Financial Bank, First Busey Corporation’s wholly-owned bank subsidiary acquired in the merger, is headquartered in Joliet, Illinois. First Community Financial Bank has nine locations in Joliet, Plainfield, Homer Glen, Channahon, Naperville, Burr Ridge, Mazon, Braidwood, and Diamond, Illinois.

In addition, First Busey Corporation owns a payment processing subsidiary, FirsTech, Inc., through Busey Bank, which processes over 27 million transactions per year using online bill payment, lockbox processing and walk-in payments at its 3,000 agent locations in 36 states.

Busey Wealth Management, Inc. is a wholly-owned subsidiary of First Busey Corporation. Through Busey Trust Company, Busey Wealth Management provides asset management, investment and fiduciary services to individuals, businesses and foundations. As of March 31, 2017, Busey Wealth Management’s assets under care were approximately $5.5 billion.

Busy Contacts 1 2 11 – Fast Efficient Contact Managers Make

For more information about us, visit www.busey.com.

Special Note Concerning Forward-Looking Statements

Statements made in this report, other than those concerning historical financial information, may be considered forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to the financial condition, results of operations, plans, objectives, future performance and business of First Busey. Forward-looking statements, which may be based upon beliefs, expectations and assumptions of First Busey’s management and on information currently available to management, are generally identifiable by the use of words such as “believe,” “expect,” “anticipate,” “plan,” “intend,” “estimate,” “may,” “will,” “would,” “could,” “should” or other similar expressions. Additionally, all statements in this document, including forward-looking statements, speak only as of the date they are made, and we undertake no obligation to update any statement in light of new information or future events. A number of factors, many of which are beyond our ability to control or predict, could cause actual results to differ materially from those in our forward-looking statements. These factors include, among others, the following: (i) the strength of the local, national and international economy; (ii) the economic impact of any future terrorist threats or attacks; (iii) changes in state and federal laws, regulations and governmental policies concerning First Busey’s general business (including the impact of the Dodd-Frank Act and the extensive regulations to be promulgated thereunder, as well as the Basel III Rules); (iv) changes in interest rates and prepayment rates of First Busey’s assets; (v) increased competition in the financial services sector and the inability to attract new customers; (vi) changes in technology and the ability to develop and maintain secure and reliable electronic systems; (vii) the loss of key executives or employees; (viii) changes in consumer spending; (ix) unexpected results of current and/or future acquisitions, which may include failure to realize the anticipated benefits of the acquisition and the possibility that the transaction costs may be greater than anticipated; (x) unexpected outcomes of existing or new litigation involving First Busey; (xi) changes in accounting policies and practices; and (xii) the economic impact of exceptional weather occurrences such as tornadoes, hurricanes, floods, and blizzards. These risks and uncertainties should be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. Additional information concerning First Busey and its business, including additional factors that could materially affect its financial results, is included in First Busey’s filings with the Securities and Exchange Commission.

An exceptional leader we know would occasionally get a question from his direct reports in a variety of forms but with the common message, “Do you want this done fast or right?” His answer was always the same: “Yes!” He chose not to compromise on either dimension. For this leader and for most highly effective leaders we know, making mistakes is not an option. But neither is slowing down.

Over the last few years we’ve been increasingly interested in the impact of a leader’s preference for speed versus a “slow and steady” mode of operation. It’s clear that overall, organizational processes, communications, and human interactions in the world are speeding up. Many organizations are looking for ways to become more agile. Perhaps leaders worry that their organizations cannot move faster if their employees operate slowly.

We created an assessment to measure an individual’s preference for moving at a slow or fast pace. In the assessment, we also measured preference for quality versus quantity. After gathering data on more than 5,000 leaders across the globe, we discovered a strong tendency for those with a fast pace to also have a strong preference toward quantity rather than quality of work. Fifty-eight percent of respondents have this preference. We also noticed that 19% had a stronger quality focus and a slower pace. This group was concerned that working faster could create errors or mistakes. Their tendency was to slow down in order to maintain high quality. (If you would like to evaluate your own pace and see how you compare, you can take it here. It’s free but we ask for your email address.)

Busy Contacts 1 2 11 – Fast Efficient Contact Managers Make

We meet many groups that, when challenged to work faster, worry doing so will cause errors and poor quality. Todoey 1 1 2 download free. The group we were interested in for this research, however, was the people who preferred a faster pace but also had a quality focus. Is this really possible? And what does it take for a leader to have both high quality and fast pace?

To research this question, we turned to another data set, one that includes information on more than 75,000 leaders. This data set contained 360-degree assessments with ratings from an average of 13 raters. In the dataset we measured a leader’s speed and their quality of output. We identified a group of leaders who were in the top quartile on both speed and quality and compared this group to all other leaders in the database. We computed statistical tests on 49 leadership behaviors. We sought to identify the most differentiating behaviors of leaders who were rated as having high levels of both speed and quality. What did they do differently from other leaders? All of the 49 behaviors were statistically significant, so we were searching for those that differentiated most powerfully.

The analysis identified seven unique factors that appear to identify what it takes to combine these two seemingly contradictory critical leadership goals.

- Provide clear strategic perspective. Leaders rated as having both high speed and high quality were absolutely clear about the vision and direction of the organization. They were also rated as better at taking a longer term, broader view. They were effective at defining that perspective and then sharing their insights with others so the strategy could be translated into challenging, meaningful goals and objectives. Naturally, knowing where the organization is going and which direction is correct would increase both speed and quality. Without a clear map, people get lost and waste a good deal of time.

- Set stretch goals and maintain high standards. Stretch goals have a natural tendency to increase speed. People will stay busy without stretch goals but will not accomplish as much. Stretch goals can increase our effort. To ensure quality these leaders also set high standards so that others knew exactly what high quality work looked like.

- Communicate powerfully. When everyone understands where they are going, what problems need to be resolved and where projects are in terms of milestones, both speed and quality increase. When people are uninformed, confused or given misleading direction, errors occur and work slows.

- Have the courage to change. Speedy leaders with high quality output became the champions of change. They were excellent at marketing projects, programs or products. Slow leaders who produce poor quality resist change.

- Consider external perspectives. Leaders who were consumed with an internal focus on the organizational problems and concerns tended to miss big shifts in the environment and customer’s preferences. This led to speed reductions and quality problems. The leaders who were top in speed and quality are skilled at looking outside the organization and identifying trends and changing mindsets early.

- Inspire and motivate others. These leaders have the ability to inspire people in the organization. Direct reports felt they were on a mission and that what they did was essential. Direct reports of uninspiring leaders feel that they just have a job and they work for their pay. Most leaders know how to push other to accomplish objectives but these leaders know how to create a pull where others wanted to deliver both excellence and speed.

- Innovate. Leaders with fast execution and high quality were always looking for a fresher, faster, more efficient way to deliver. Having a desire to increase both speed and quality using standard procedures is often impossible and therefore requires new innovative procedures. Leaders who look for innovative solutions find a way to have the best of both worlds.

An increasing number of roles require high speed combined with high quality. We believe this achievement is possible.

Busy Contacts 1 2 11 – Fast Efficient Contact Managers

UNDER MAINTENANCE